[ad_1]

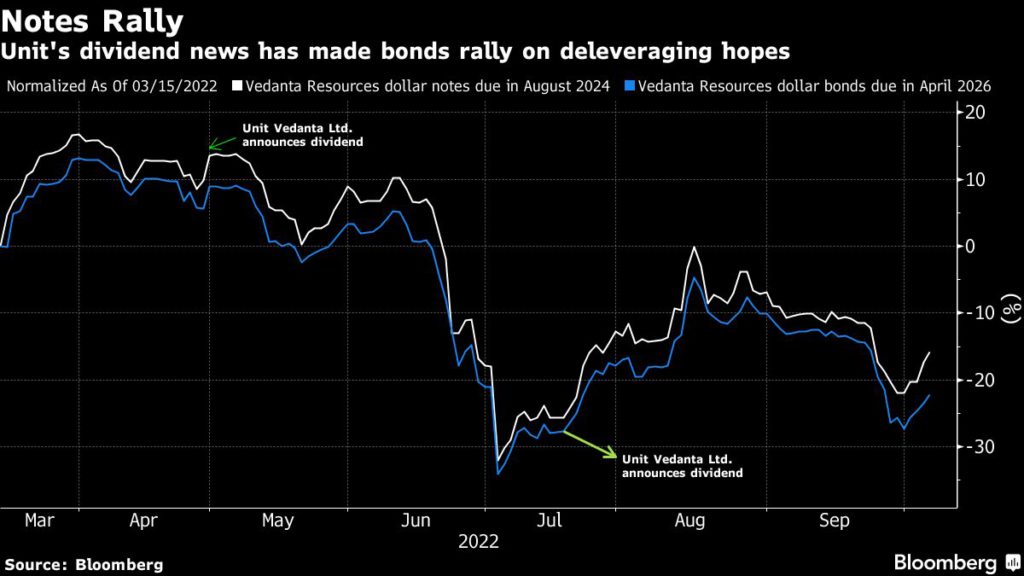

Dividends from the unit have turn out to be a serious supply of funds lately for the London-based guardian to repay its debt. If Vedanta Assets does get a dividend, that might enable it to drift a young supply for not less than a part of $900 million of notes due in 2023, that are buying and selling at about 94 cents on the greenback. That contrasts with the costs on its greenback securities that mature in 2024, that are indicated round 61 cents. Ranges beneath 70 cents are usually thought-about distressed.

It’s a second of reckoning for Agarwal, 68, who acquired his begin as a scrap metals dealer and constructed a commodities empire over 20 years that’s India’s largest producer of aluminum and zinc. Certainly one of Agarwal’s closely-held corporations can also be working with Hon Hai Precision Business Co., the assembler of many of the world’s iPhones, to construct a chipmaking facility within the state of Gujarat.

However the group’s fast growth together with acquisitions of steel firms has left it with an $11.7 billion debt load as of March, and Moody’s Buyers Service famous its “persistently weak liquidity” in an August report. Getting the dividend payout could assist allay investor considerations about its funds within the close to time period.

“There’s a excessive probability of the shareholders approving the transfer of money from normal reserves to retained earnings as there may be the opportunity of dividend funds,” mentioned A.Ok. Prabhakar, head of analysis at IDBI Capital Market Providers Ltd. “Transparency has all the time been a difficulty with Vedanta however new traders like the corporate for its aggressiveness and dividend paying functionality.”

Haitong Worldwide Asset Administration Ltd. holds some Vedanta Assets bonds. It sees a small risk that the corporate could both name again notes this yr or float a partial or full buyback supply for bonds due subsequent yr in case Vedanta Ltd. broadcasts one other huge dividend, mentioned fund supervisor Sunny Jiang.

Vedanta Assets is in a “very snug place” to satisfy all its debt obligations, the corporate mentioned by electronic mail, and declined to touch upon the opportunity of the agency shopping for again bonds due subsequent yr.

Investor nervousness about Vedanta Assets just isn’t new and its bond yields climbed to double-digits in 2020. Nevertheless, a restoration in income pushed by booming demand after the pandemic and multi-year-high steel costs eased considerations over its means to satisfy debt obligations.

How did the corporate get so huge?

Vedanta Assets was the primary Indian enterprise to record in London again in 2003, earlier than Agarwal took it personal 15 years later when his Volcan Investments Ltd. purchased out minority traders as a part of efforts to streamline the group’s construction.

Mumbai-listed unit Vedanta Ltd. was constructed on a sequence of bold acquisitions by Agarwal: In 2001, he purchased management of then government-owned Bharat Aluminium Co. in one of many first assessments of India’s efforts to dump state holdings. Agarwal adopted that up with the acquisition of one other state-run agency, Hindustan Zinc Ltd. He efficiently bid for iron ore producer Sesa Goa Ltd. in 2007 and for Cairn India, regardless of having no oil and fuel expertise. Vedanta Assets additionally owns copper and zinc operations in Africa.

Vedanta Assets has previously tried to take the Indian unit personal to have better management on the money flows however the plan was obstructed by minority shareholders.

What’s taking place now?

Vedanta Assets holds about 70% within the Indian unit. Dividends to Vedanta Assets from Vedanta Ltd. totaled about $1.5 billion within the monetary yr ended March, with an extra $932 million in April, based on Bloomberg Intelligence. In July, Vedanta Ltd. introduced one other dividend of near a billion {dollars}. There are considerations although that the danger of an financial recession could put extra strain on commodity costs, and have an effect on its means to move on bigger dividends.

The unit had 125.9 billion rupees ($1.5 billion) of normal reserves as of March 31, 2021, based on the newest firm knowledge accessible. It additionally had money and equivalents of about 343.4 billion rupees as of June 30, firm filings present.

What are stakeholders saying?

The corporate’s liquidity and sophisticated company construction are main considerations for strategist and bondholders. Most have dominated out a risk that Vedanta Assets will train name choices this quarter on two of its 2024 dollar-denominated notes amounting to $2 billion because the securities are buying and selling method beneath par.

The spiraling price of issuing new debt and the corporate’s stretched funds are the foremost causes cited for why it won’t retire its debt on the first alternative.

“The chance of Vedanta calling the notes may be very low,” mentioned Trung Nguyen, senior credit score analyst at Lucror Analytics Pte. “Entry to capital is tough in the intervening time. Thus, Vedanta would wrestle to seek out money to name the notes.”

(By Divya Patil and Swansy Afonso, with help from Malavika Kaur Makol and Beth Thomas)

[ad_2]

Supply hyperlink